FinOptions API 3.0.1 Details

Shareware 5.8 MB

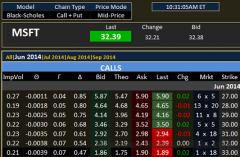

FinOptions API is a COM compliant financial analytics library that values option price, risk sensitivities and implied volatility on a broad range of financial instruments including options, futures, exotic, bond options and interest rate assets. FinOptions API is a straightforward and easy-to-use COM compliant financial analytics software library powered by an ultra-efficient processing engine that can analyze derivatives with lightning speed.

Publisher Description

The FinOptions API analytics library is a comprehensive suite of derivative models with extensive cross asset coverage for the financial professional. Built to support the demand of today's financial markets, FinOptions API gives you the ultimate in accuracy and flexibility to handle complex products and obtain critical risk information required to drive your business objectives and manage your portfolio of derivatives.

Using market data from your quote vendor, FinOptions API allows you to value portfolio positions in real-time, including sensitivities such as delta, gamma, theta, vega, rho, psi and lambda or calculate implied volatility values based on the prices of exchange traded options.

With over 60 optimized financial functions, the Derivicom FinOptions API analytics library helps you deliver advanced, easy-to-create business solutions fast. Value options contracts on various assets including stocks, futures, indices, commodities, foreign exchange, fixed income securities, and Employee Stock Options (ESOs). Additionally, various exotic type contracts may be valued such as Average Price and Rate (Asian options), Barrier, Binary, Chooser, Compound, Currency-Translated, Lookback, Portfolio, Rainbow and Spread options. Complex interest rate and bond option pricing and analytics along with historical volatility evaluation and curve fitting functions are included in this comprehensive suite.

The FinOptions API is a straightforward and easy-to-use COM compliant financial software library powered by an ultra-efficient processing engine so that regardless of dataset size, you can analyze derivatives at lightning speeds.

The FinOptions API financial library enables you to quickly integrate advanced derivative analytics into your custom software solutions. From the intuitive object model to the clear and concise examples, the FinOptions API gives you the power to meet and exceed user expectations, today.

The FinOptions API analytics library is a comprehensive suite of derivative models with extensive cross asset coverage for the financial professional. Built to support the demand of today's financial markets, FinOptions API gives you the ultimate in accuracy and flexibility to handle complex products and obtain critical risk information required to drive your business objectives and manage your portfolio of derivatives.

Using market data from your quote vendor, FinOptions API allows you to value portfolio positions in real-time, including sensitivities such as delta, gamma, theta, vega, rho, psi and lambda or calculate implied volatility values based on the prices of exchange traded options.

With over 60 optimized financial functions, the Derivicom FinOptions API analytics library helps you deliver advanced, easy-to-create business solutions fast. Value options contracts on various assets including stocks, futures, indices, commodities, foreign exchange, fixed income securities, and Employee Stock Options (ESOs). Additionally, various exotic type contracts may be valued such as Average Price and Rate (Asian options), Barrier, Binary, Chooser, Compound, Currency-Translated, Lookback, Portfolio, Rainbow and Spread options. Complex interest rate and bond option pricing and analytics along with historical volatility evaluation and curve fitting functions are included in this comprehensive suite.

The FinOptions API is a straightforward and easy-to-use COM compliant financial software library powered by an ultra-efficient processing engine so that regardless of dataset size, you can analyze derivatives at lightning speeds.

The FinOptions API financial library enables you to quickly integrate advanced derivative analytics into your custom software solutions. From the intuitive object model to the clear and concise examples, the FinOptions API gives you the power to meet and exceed user expectations, today.

Download and use it now: FinOptions API

Related Programs

Binary Option Robot

Improve your online trade chances Binary Option Robot merely acts as a portal between you and the trades that are being made in the time you are using it. To be able to participate in the trade, you need to...

- Freeware

- 20 Jul 2015

- 13.86 MB

Options Trading Tool

This program helps you as options trader to optimize your strategy. You can add all the options you want to buy or sell and build your strategy. The program shows you the profit and loss graph at expiration and on...

- Shareware

- 09 Sep 2015

- 1.64 MB

Pricing and Breakeven Analysis

Pricing and Breakeven Analysis Excel will determine the impact of a price change on your business. It calculates current breakeven points using revenue, variable cost, and fixed cost inputs. These are combined with estimates for price and sales volume variations...

- Shareware

- 15 Apr 2017

- 105 KB

PCLTool SDK Option III

PCLTool SDK Option III is ideal for developers who need to capture and convert legacy PCL print streams into a PDF, PDF/A or XPS file formats while extracting all of the text. Unlike PCLTool SDK Option V, it does not...

- Demo

- 20 Jul 2015

- 113.79 MB

PCLTool SDK Option V : PCL to PDF

PCLTool SDK Option V converts COMPLEX PCL into PDF, PDF/A, or any of our supported formats while extracting text. Option V is our most powerful product, providing full access to all of our TPT (Transformation Parameter Table) scripting functions. PCLTool...

- Demo

- 20 Jul 2015

- 113.79 MB